Welcome to CalSaversHelp.com Call us at 1-888-No-Worries (669-6774) with any questions or send email to info@401kAdministrators.com

CalSavers is a Payroll deduction IRA retirement plan offered by the State of California.

Contributions are made on an after tax basis which means that you do not get a tax deduction for contributing and you do not lower your taxes by contributing to the CalSavers Payroll IRA

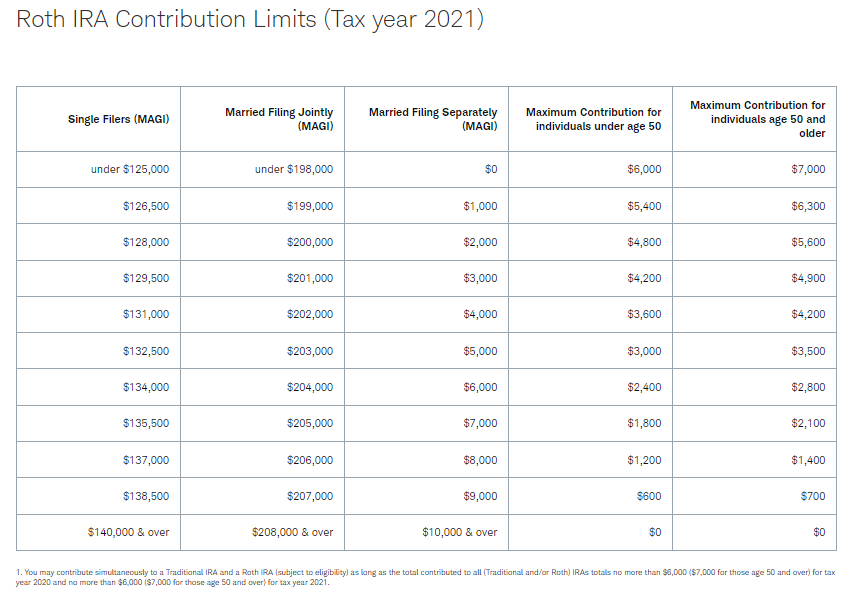

Roth IRA contributions are made on an after-tax basis. However, keep in mind that your eligibility to contribute to a Roth IRA is based on your income level. If you file taxes as a single person, your Modified Adjusted Gross Income (MAGI) must be under $139,000 for the tax year 2020 and under $140,000 for the tax year 2021 to contribute to a Roth IRA, and if you're married and file jointly, your MAGI must be under $206,000 for the tax year 2020 and 208,000 for the tax year 2021. The maximum total annual contribution for all your IRAs combined is:

$6,000 if you're under age 50

$7,000 if you're age 50 or older

This chart shows you what the contribution limits are for a CalSavers IRA 2021:

Note that a 401k plan does not have an income limit that would reduce your contributions or prevent you from contributing altogether.